Artificial Intelligence Boom and Tech Leadership: Choosing the Best Stocks.

- Sanzhi Kobzhan

- Nov 27, 2025

- 10 min read

Updated: Nov 28, 2025

The artificial intelligence (AI) boom is reshaping the stock market, catapulting a handful of tech companies to new heights. Over the past couple of years, investor enthusiasm for AI has driven remarkable gains in tech stocks – so much so that the S&P 500 index climbed nearly 70% since the end of 2022, largely fueled by AI optimism.

With AI becoming a transformative force across industries, companies that lead in AI technology have emerged as the new tech leaders in the market. However, amid the hype, smart investors (beginners and veterans alike) are focusing on strong fundamentals to identify which of these AI-driven tech stocks are truly the best picks for the long run. In this article, I will break down the AI stock boom, highlight key tech leaders (with a focus on NVIDIA and Broadcom), and show how to evaluate these companies using key financial ratios and tools like the Stocks2Buy Fundamentals Analyzer app.

Understanding the AI Stock Boom

The AI boom refers to the surging adoption of artificial intelligence technologies and the corresponding explosive growth in businesses that enable AI. In late 2023 and 2024, breakthroughs in generative AI (like large language models) sparked a wave of investment in AI infrastructure and software.

Tech companies supplying the “picks and shovels” of this revolution – from advanced computer chips to cloud AI services – saw demand skyrocket. For example, Nvidia’s revenue doubled or even tripled year-over-year for five consecutive quarters during 2023 and 2024, reflecting insatiable demand for its AI chips. This kind of growth is unprecedented and has pushed stock prices sharply higher across the sector.

That said, not every tech company benefits equally. The AI boom’s rewards have been concentrated in a few key players with the technology and scale to capitalize on the trend. This has drawn comparisons to past tech frenzies (like the dot-com era), but there is an important difference: many of today’s AI leaders are profitable, established companies with real cash flows.

In other words, investors are betting on actual earnings and growth, not just hype. The challenge (and opportunity) for investors is figuring out which companies have the fundamental strength to justify their soaring stock prices. This is where understanding tech leadership and applying solid stock analysis comes in.

Tech Leadership in the AI Era

In the current AI era, tech leadership is being defined by those companies that provide critical AI hardware, software, or services – and do so better than anyone else. A short list of the top AI-focused tech leaders typically includes companies like NVIDIA, Broadcom, Advanced Micro Devices (AMD), and the cloud giants (such as Microsoft, Google, and Amazon). These companies are pouring billions into AI and are at the forefront of innovation.

For beginner and intermediate investors, it’s useful to know who these leaders are and why they stand out:

NVIDIA (NVDA)

The undisputed leader in AI chips, NVIDIA’s graphics processing units (GPUs) have become the workhorses for training and running AI models. This dominance in AI hardware has made NVIDIA one of the world’s most valuable companies (it even joined the trillion-dollar market cap club in 2023). The company’s CEO Jensen Huang often says “AI is fueling an industrial revolution” – and NVIDIA is providing the engines for that revolution. NVIDIA’s stock price surged as its data-center GPU sales boomed, and it continues to hold a wide lead in performance and ecosystem (thanks to its CUDA software platform). Simply put, NVIDIA’s tech leadership in AI is evidenced by both its market share and its financial results.

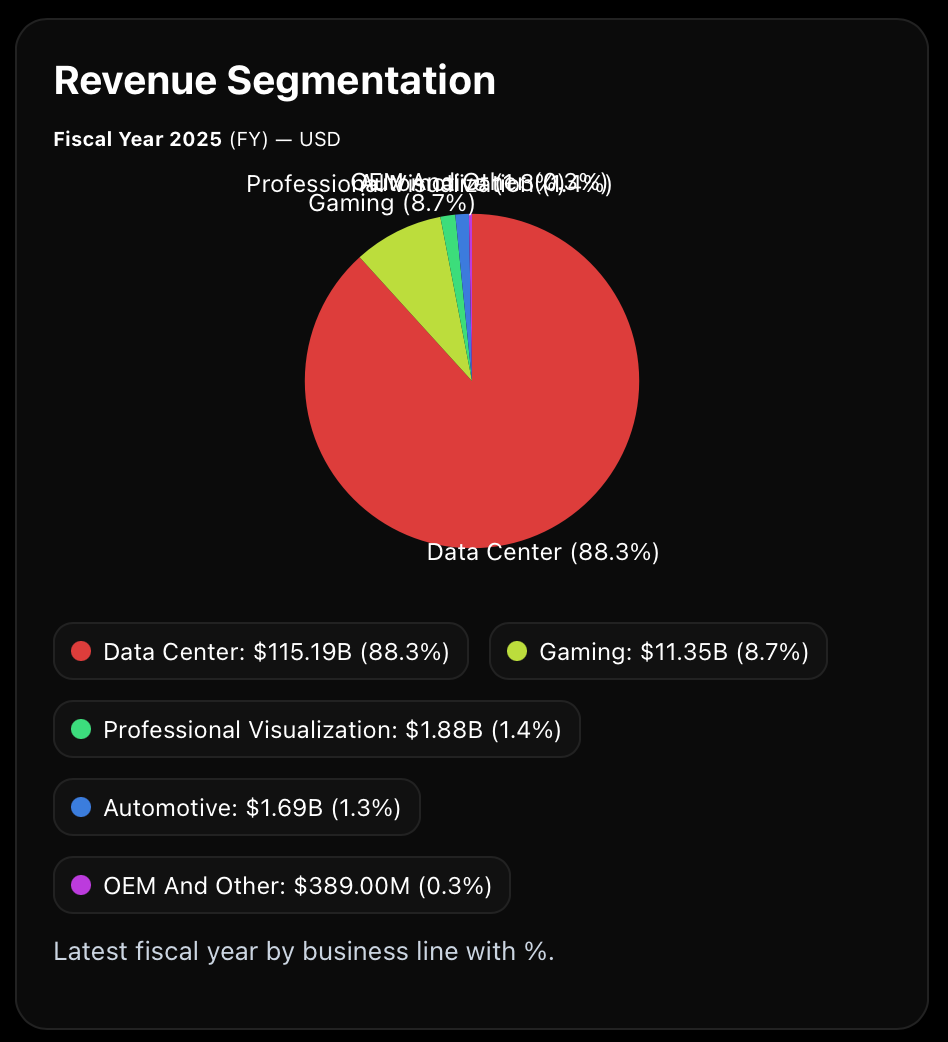

NVDA's revenue segmentation. Stocks2Buy Fundamentals Analyzer app

Broadcom (AVGO)

Broadcom is a less headline-grabbing name in AI, but it has quietly become an AI infrastructure leader. Broadcom produces custom application-specific integrated circuits (ASICs) and specialized chips that help power AI systems, as well as networking solutions that link AI servers together. In fact, Broadcom’s custom AI accelerators are in high demand among hyperscale cloud providers, and its networking chips (like the recent Tomahawk 6 series) act as the “glue” connecting sprawling AI data centers. Thanks to this, Broadcom has enjoyed a significant boost from the AI trend – the company saw a 63% increase in AI-related revenue in a recent quarter, reaching about $5.2 billion in AI sales. Broadcom’s strategic expansion (including the acquisition of VMware in 2023 for software and cloud capabilities) positions it as a key player bridging hardware and software in the AI ecosystem.

AVGO's revenue segmentation. Stocks2Buy Fundamentals Analyzer app

Other Notable Leaders

While NVIDIA and Broadcom are the focus of our discussion, other tech giants also play leadership roles in AI. AMD, for example, is NVIDIA’s chief rival in AI chips and has been rapidly improving its AI processors (though it still trails NVIDIA in market share).

Microsoft and Alphabet (Google) have taken leadership in AI software and cloud services – Microsoft through its partnership with OpenAI (and integrating AI into products like Azure and Office), and Google with its AI research and products (like its Tensor Processing Unit chips and Bard AI).

These companies’ leadership might be more on the software side, but they illustrate that the AI boom is multi-faceted. For investors, the common theme is that leadership in AI translates to competitive advantage and revenue growth. The more a company is ahead of others in AI capabilities, the more it stands to profit from the ongoing AI wave.

Nvidia: The AI Chip Powerhouse

NVIDIA’s role in the AI boom cannot be overstated – it’s often referred to as the “AI chip powerhouse” for good reason. The company’s high-end GPUs (like the A100 and H100 series) are essential for training sophisticated AI models, from image recognition to large language models. As a result, demand for NVIDIA’s chips has been off the charts. The company has reported record revenues and profits over the last two years, driven largely by its data center division (which includes AI chip sales).

To put this in perspective, NVIDIA’s annual sales exploded from around $44 billion in fiscal 2024 to a projected $200+ billion in its current fiscal year, an almost fivefold jump. This kind of growth is extraordinary for a company of NVIDIA’s size, and it reflects how central NVIDIA is to the AI revolution.

From an investor’s standpoint, NVIDIA’s financial fundamentals underscore its tech leadership:

Massive Profitability

NVIDIA has very high profit margins thanks to the premium pricing and volume of its AI chips. Its net profit margin over the last 12 months is about 52%, meaning more than half of each dollar of revenue turns into profit. This is exceptionally high – for comparison, the net margin for the average S&P 500 company is usually under 15%. Even other chipmakers don’t come close; for instance, AMD’s net profit margin is roughly 10%, highlighting NVIDIA’s superior profitability. Such high margins indicate strong pricing power and efficient operation.

Return on Equity (ROE)

NVIDIA’s ROE, a measure of how effectively a company uses shareholders’ equity to generate profit, has soared into the triple digits. Currently, NVIDIA’s ROE is around 103% – an almost unheard-of level in the industry. (This was achieved because of NVIDIA’s surging net income over the past year.)

NVDA's Key Financial Metrics. Stocks2Buy Fundamentals Analyzer app

By contrast, AMD’s ROE is only about 5.6%. A high ROE can signal a highly efficient, profitable business – NVIDIA is earning a remarkable return on every dollar invested in the company.

AMD's Key Financial Metrics. Stocks2Buy Fundamentals Analyzer app

Market Leadership and Valuation

NVIDIA’s stock price skyrocketed amid its AI success, making it one of the most valuable companies in the world. For a time in 2023–2024, NVIDIA’s market capitalization hovered around $1 trillion (and continued strong performance has pushed it even higher since then). This does mean the stock trades at a rich valuation – for example, its price-to-earnings (P/E) ratio was around 40–50+ in late 2025. However, investors have been willing to pay a premium for NVIDIA due to its dominant position and growth prospects.

Interestingly, because NVIDIA’s earnings have jumped so much, its P/E isn’t as extreme as some might think; it’s roughly in line with many high-growth tech stocks and even lower than some peers (AMD’s P/E was over 100 in recent data, partly because AMD’s earnings are much smaller by comparison). The key point is that NVIDIA combines high growth with high profitability, a recipe that justifies its leadership status in AI.

In summary, NVIDIA exemplifies what an AI boom leader looks like: it has the must-have product (AI GPUs), nearly uncontested market share in its niche, and financial performance to back up the hype. Beginner investors looking at NVIDIA should note both the huge opportunity (AI is in its early innings, potentially meaning years of growth ahead) and the importance of fundamentals (even a great company can be a bad investment if bought at too high a price, so keep an eye on those ratios and growth rates).

Broadcom: Riding the AI Infrastructure Wave

While NVIDIA grabs most of the AI headlines, Broadcom (AVGO) is another tech leader benefiting significantly from the AI boom – albeit in a somewhat different way. Broadcom is a diversified semiconductor and infrastructure software company. In the context of AI, Broadcom’s contribution is often described as providing the “plumbing and picks” that make large-scale AI possible. This includes custom AI accelerator chips for big cloud customers and networking equipment like switches that connect thousands of AI servers in data centers.

Broadcom’s financial results in the recent AI surge show strong fundamental performance that validates its leadership:

Robust Revenue and Earnings Growth

Broadcom has enjoyed healthy growth thanks to AI. In its fiscal third quarter of 2025, Broadcom reported a record revenue of about $15.95 billion, beating analyst expectations.

AVGO's Earnings. Stocks2Buy Fundamentals Analyzer app

Notably, AI-related demand was a big driver of this performance – the company’s AI-specific revenue jumped 63% year-over-year to reach $5.2 billion in the quarter. CEO Hock Tan has been optimistic on AI trends, even forecasting Broadcom’s AI semiconductor revenue to rise further to $6+ billion next quarter. For a company of Broadcom’s size, these are impressive growth figures, indicating it is successfully riding the AI infrastructure wave.

Profitability and Cash Flow

Broadcom might not have NVIDIA-level profit margins, but it is still a highly profitable business. Broadcom’s 12-month net profit margin stands around 31–32%, which is excellent (most companies would envy a 30% margin). This margin is a bit lower than NVIDIA’s ~52%, reflecting different business mixes, but still far above typical industry averages.

More importantly, Broadcom generates strong cash flow. In that same Q3 2025, it produced $7.17 billion in operating cash flow and $7.02 billion in free cash flow (cash profits after capital expenses), which was 44% of revenue – an indicator of strong operational efficiency.

AVGO's Financial Statement Growth. Stocks2Buy Fundamentals Analyzer app

Such robust free cash flow means Broadcom can comfortably invest in R&D, make strategic acquisitions, and return capital to shareholders (Broadcom is known for its sizable dividend and buybacks).

Valuation and Stability

Unlike the more volatile pure-play growth stocks, Broadcom has a reputation as a somewhat steady compounder in the tech space. Its stock has trended upward over the years, and the AI boom added extra fuel in 2023–2025 (Broadcom’s stock price hit all-time highs as investors recognized its AI leverage). Broadcom’s valuation in terms of P/E ratio is generally lower than NVIDIA’s – partly because it’s a larger, more diversified company with moderate growth outside of AI.

This can make Broadcom attractive to investors who want AI exposure with a bit less volatility. Additionally, Broadcom’s pending acquisition of VMware (a major software company) indicates an expansion beyond semiconductors, which could provide more stable software revenues in the long run. The blend of hardware and software earnings might help Broadcom maintain strong profits even if the hardware cycle fluctuates.

In essence, Broadcom stands out as a tech leader in AI infrastructure. It may not be as synonymous with AI as NVIDIA in the public eye, but its strategy of positioning itself in critical parts of the AI supply chain (custom chips, networking, and software integration) has paid off handsomely.

For investors, Broadcom is a reminder that the AI gold rush isn’t only about who sells the final product, but also about who sells the tools to the miners. Broadcom sells a lot of those tools, and does so very profitably.

Choosing the Best Stocks.

Investing in the AI boom can feel exhilarating yet daunting, especially for newer investors. It’s easy to get swept up in futuristic talk and skyrocketing stock charts. To wrap up, let’s highlight a few key takeaways in a clear, concise manner:

The AI Boom is Real (and Here to Stay): AI is not a fad – it’s driving tangible growth for tech leaders. Companies like NVIDIA and Broadcom are reporting record revenues and earnings thanks to AI demand. This trend could continue for years as AI adoption expands, potentially rewarding investors who choose the right winners.

Tech Leadership Matters: A small number of companies are capturing outsized benefits from AI. NVIDIA’s dominance in AI chips and Broadcom’s strength in AI infrastructure illustrate how being the leader in a niche can translate to massive financial gains. As an investor, focusing on the market leaders (and understanding why they are leaders) can help you position your portfolio in front of major trends.

Fundamentals Are Your Friend: No matter how exciting a story is, always check the numbers. High profit margins, strong cash flows, reasonable valuations, and manageable debt levels provide a margin of safety. My analysis showed that NVIDIA’s metrics outshine many peers, which supports its lofty valuation, whereas a weaker competitor might not justify its price. Always compare peers – the best stock in a hot sector is the one with both growth and solid fundamentals.

Use Tools to Make Informed Decisions: You don’t have to crunch all the numbers by hand. Tools like the Stocks2Buy Fundamentals Analyzer app can quickly compare financial ratios, growth rates, and valuations for you. It helps distill complex data into an easy-to-understand format, guiding you toward stocks that are undervalued or fundamentally strong among their peers.

Stay Diversified and Think Long-Term: Finally, even with high conviction in AI, maintain a balanced approach. Tech leadership can shift (today’s leader could face competition tomorrow), and markets can be volatile. It’s wise to diversify across several strong companies and not put all your capital into one stock or theme. If you invest in quality companies with durable advantages, time is on your side – long-term growth and compounding can work wonders.

By keeping a confident, purposeful focus on both the exciting growth story of AI and the clear facts revealed by fundamental analysis, beginner and intermediate investors can navigate the AI boom with greater clarity. The tone we aim for – one of credibility and efficiency – comes from doing our homework on these companies.

In practice, that means celebrating tech innovations like AI while also reading the financial statements with a discerning eye. The AI revolution in tech is underway, and with the right knowledge and tools, you can participate in it intelligently. Happy investing!

Comments